Tekla Healthcare CEF Trading Below NAV (NYSE:HQH)

[ad_1]

janiecbros

If you are a little leery of the stock market right now and are looking to park a portion of your money in something that can produce income, Tekla Healthcare Investors (NYSE:HQH) is a CEF to consider. It is possible that the market moves lower as interest rates increase, leading to a slowdown in economic activity and a potential recession within about one year. Tekla is currently yielding about 10% and trading below its net asset value [NAV]. Therefore, this CEF can be a good way to earn a high yield while inflation remains high, interest rates increase, and the market looks uncertain.

Tekla Healthcare Investors is one of four offerings from Tekla Funds. All of the CEFs are healthcare related, but each one has different portfolios of healthcare-related equities.

Tekla Healthcare’s Portfolio

Tekla Healthcare Investors has its portfolio concentrated on biotechnology, pharmaceutical, and medical device companies. This CEF strives to invest in companies with above-average growth potential. This strategy allows the fund to pay dividends with a strong yield while preserving capital over the long-term.

The top ten holdings include: Amgen (AMGN) (7.7% of fund), Regeneron Pharmaceuticals (REGN) (5.6%), Vertex Pharmaceuticals (VRTX) (5.1%), Gilead Sciences (GILD) (5%), Horizon Therapeutics (HZNP) (4.8%), Illumina (ILMN) (4.4%), Seagen (SGEN) (2.4%), Moderna (MRNA) (2.3%), AstraZeneca (AZN) (2.3%), and UnitedHealth Group (UNH) (2.2%).

Biotechnology comprises the majority of holdings with a concentration of 52.4%. Pharmaceuticals comprise 20.2% of HQH. Other healthcare-related equities comprise the remainder of the fund with single-digit concentrations. This includes Healthcare Equipment & Supplies, Life Sciences Tools and Services, Healthcare Providers, etc.

What I like about the portfolio is that the fund is comprised of well-established and profitable biotech and pharma companies. Three of the top ten holdings have a strong buy rating according to Seeking Alpha’s quant ratings system: Vertex, Astra Zeneca, and UnitedHealth. Horizon has a buy quant rating. All of the other top ten holdings have hold quant ratings.

While I won’t analyze all of the top ten, I will look at the top holdings. It is important to analyze Amgen since it comprises 7.7% of the fund. Amgen is trading with a reasonable valuation with a forward PE of 13. This is below the S&P 500’s (SPY) forward PE of 16.7. Amgen’s forward PE is based on expected EPS of $18.99 for 2023. That represents a potential 9% gain over the expected 2022 EPS of $17.45. So, Amgen’s stock looks like it has room to move with a reasonable valuation and future potential growth.

Regeneron also has a reasonable valuation with a forward PE of 14 based on expected EPS of $43.31 for 2023. However, Regeneron’s EPS for 2023 is expected to be slightly less than the expected EPS for 2022 of $43.51. So, the company may need a positive catalyst such as additional acquisitions. The company did complete its acquisition of Checkmate Pharmaceuticals in May 2022. However, this is already factored into current earnings estimates.

Vertex is expected to grow earnings at about 8% to 9% in 2023. However, it is valued with an above-average forward PE of about 19. So, there may not be much upside for the stock over approximately the next year.

Gilead is trading with an attractive forward PE of 10 based on expected EPS of $6.32 for 2023. However, this is 3.5% below the expected EPS of $6.55 for 2022. Therefore, the stock may get a little boost on PE expansion in spite of its stagnant growth.

Horizon looks positive on valuation and growth. Horizon trades with a forward PE of just 11.5 based on expected EPS of $7.15 for 2023. The company is expected to grow earnings at 21% 22% in 2023. This valuation and growth combo has analysts giving the stock a one-year price target of $137.50 which is 67% above the current price. Maybe Tekla should make Horizon a larger portion of HQH?

Distribution History

HQH has a managed policy of distributing 2% of the fund’s net assets to shareholders. The distributions did increase in some years. However, the payments so far in 2022 are lower than the distributions paid in the 1st 2 quarters of 2021. So, investors can’t rely on HQH to consistently increase the distribution payments each year.

Personally, I would prefer to see regular annual distribution increases from this fund. The distributions will depend on the performance of the underlying companies. Those companies may not have consistent growth to support distribution increases on an annual basis.

Trading Below NAV

One of the positive things about HQH is that it is currently trading 4% below its net asset value of $20.02. This discount provides some potential upside for the price of the fund.

One of the disadvantages of HQH is that the price underperformed the S&P 500 since the late nineties. Of course, HGH investors are more interested in the distribution income from the fund rather than price appreciation. If you are going to

enter this fund, you might as well get it when it trades below NAV.

Technical Perspective

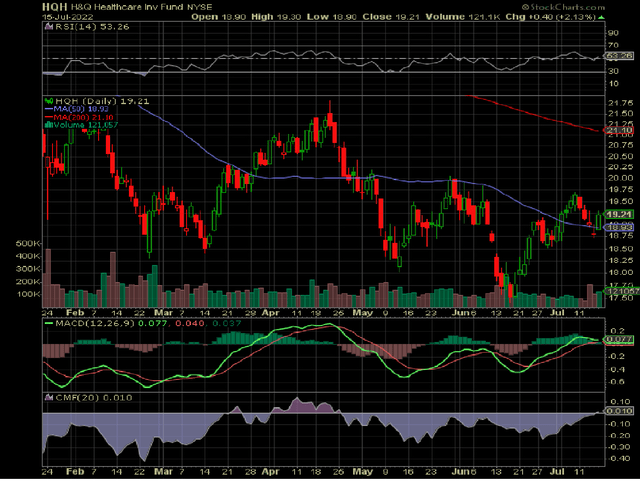

StockCharts

It looks like the stock price formed a reverse head and shoulders on the daily chart, which is bullish. The RSI is showing strength as it rose above 50. The green MACD line remains above zero and above the red signal line which is positive. The money flow [CMF] increased to slightly above zero, which shows that money has been flowing back into the fund. The technical evidence points to further upside for the fund’s underlying price, which is consistent with the fund trading below NAV.

Tekla Healthcare’s Outlook

While the underlying price tends to lag the S&P 500 over the long-term, the price should have some upside as it trades 4% below NAV. I would prefer to see consistent distribution increases on an annual basis. However, history shows us that Tekla does not do this.

The good news is that the fund might hold up well given the uncertain situation for the economy in a rising interest-rate environment. Consumers are unlikely to cut back on their healthcare spending as it fulfills their basic needs. However, the underlying companies in the fund would have to pay more for acquisitions if they need to finance them in a higher interest-rate environment.

The bottom line is that HQH can be a place to earn regular income during uncertain times. The yield of 10% is attractive for income investors. The underlying price has the potential to hold up better than riskier stocks or funds in uncertain times. This is reinforced since the fund trades below NAV.

[ad_2]

Source link