Woman Breaks Down Scary Costs of U.S. Health Insurance

[ad_1]

A Twitter thread claiming to offer a sobering breakdown of how health insurance in the U.S. works has gone viral.

The thread was posted by a woman writing under the handle Infosec_Taylor and has been retweeted over 23,000 times and liked 97,000 times.

According to the CDC, when it comes to health care, an estimated 11.5 percent of the U.S. adult population is uninsured, which equates to around 31.2 million Americans.

Yet if the numbers detailed in Infosec_Taylor’s viral thread are correct, it’s not difficult to see why protection of this kind is unattainable for some.

Writing on Twitter, the woman said she was posting the thread because she is aware that most of her “non-U.S.” friends probably were not aware how the country’s health insurance system works.

I just realized my non-US friends probably don’t know how US insurance works.

So lets say your employer offers insurance. They pay a portion and then you pay a portion. For a family, the employee pays on average about $400 per pay cycle, or $10,400 per year.

— Ashley (@Infosec_Taylor) April 10, 2022

This does not mean all your medical care is then covered by insurance. Nope, not even close.

Most doctors visits have a co-pay, meaning you pay this to even be seen. It’s anywhere from $20 to $200 depending on emergencies.

Insurance also requires you to pay a deductible…

— Ashley (@Infosec_Taylor) April 10, 2022

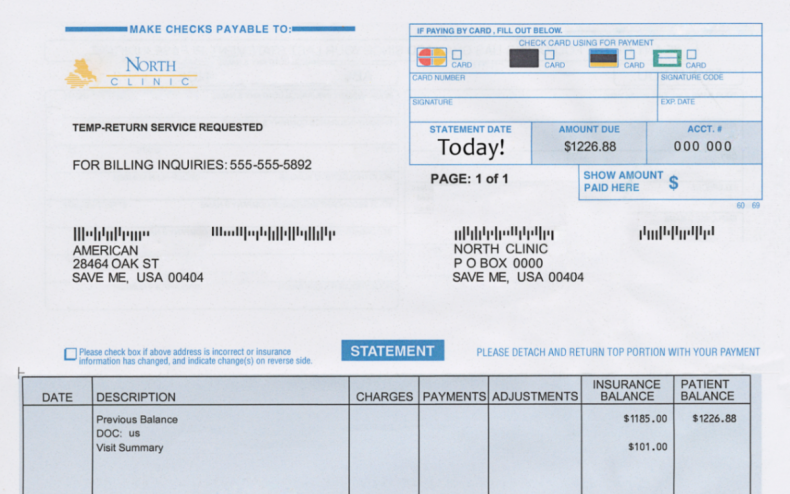

before they kick in. So let’s say your deductible is $1000. That means for each visit, you owe $1000 before they start covering.

But they “negotiate” with hospitals, so an MRI out of pocket might cost $5000, but through insurance only costs $400, so you pay $400.

— Ashley (@Infosec_Taylor) April 10, 2022

“So let’s say your employer offers insurance,” Infosec_Taylor states. “They pay a portion and then you pay a portion. For a family, the employee pays on average about $400 per pay cycle, or $10,400 per year.”

However she quickly adds: “This does not mean all your medical care is then covered by insurance. Nope, not even close.”

She claims most doctor visits require patients to pay “to even be seen” with the price allegedly ranging from “$20 to $200 depending on emergencies” and that even with health insurance they will be expected to pay a “deductible” before cover kicks in.

“So let’s say your deductible is $1,000,” she writes. “That means for each visit, you owe $1,000 before they start covering.” But here’s where things get complicated again.

Infosec_Taylor alleges insurance companies will often “negotiate” with hospitals, meaning something like an MRI is priced below $1,000 so the patient covers the cost themselves.

After awhile, there is a “max out of pocket” which means you pay $20,000 out of pocket for all these little visits and then insurance will cover anything further 100% for the year.

— Ashley (@Infosec_Taylor) April 10, 2022

Oh, but insurance doesn’t cover EVERYTHING. They agree to certain exclusions… like maybe they don’t cover an ambulance ride or only partially cover major dental. Oh and they typically don’t cover regular dental or eye care at all (that’s a different insurance you buy).

— Ashley (@Infosec_Taylor) April 10, 2022

She claims there is also something called “max out of pocket” which means that once these out of pocket costs hit a certain figure, the insurance will cover all of the costs for anything further for the remainder of the year.

But, again, it’s not entirely straightforward.

According to Infosec_Taylor’s thread, insurance “doesn’t cover everything” with providers including “certain exclusions.” As an example she claims some “don’t cover an ambulance ride or only partially cover major dental.”

She also alleges that insurance companies only negotiate with “certain doctors and clinics” so “if you don’t use them they only cover your care 50 percent instead of 80 percent and the deductibles are higher.”

And the insurance only negotiates with certain doctors and clinics… so if you don’t use them they only cover your care 50% instead of 80% and the deductibles are higher.

But, if you get hospitalized, the insurance might cover the facility and nurses, but the doctors can be…

— Ashley (@Infosec_Taylor) April 10, 2022

out of network, so you have to pay more without any say in the matter. And medical facilties, even ERs, can just choose not to take any insurance. It isn’t a requirement they take it.

— Ashley (@Infosec_Taylor) April 10, 2022

The woman warns that in the event someone is hospitalized, they might find that the insurance covers the facility and nurses but that their doctor is “out of network,” meaning the patient has to pay more “without any say in the matter.”

She also claims that some medical facilities can even “choose not to take any insurance” as it “isn’t a requirement they take it.”

Infosec_Taylor alleges that the problems extend into prescriptions and treatments with insurance companies about to “step in and dictate” care. “So let’s say you bang up your knee and need an MRI plus surgery,” she writes. “The doctor agrees and you agree, but the insurance company says ‘No, you need physical therapy first.’

“So in order to have the MRI plus surgery covered, you now need to go through months of physical therapy before it will be approved. You could always just pay outside of insurance, but now you are paying $12k of your money instead of $3k and months of pain.”

So let’s say you bang up your knee and need an MRI plus surgery. The doctor agrees and you agree, but the insurance company says “No, you need physical therapy first.” So in order to have the MRI plus surgery covered, you now need to go through months of physical therapy…

— Ashley (@Infosec_Taylor) April 10, 2022

So let’s say you bang up your knee and need an MRI plus surgery. The doctor agrees and you agree, but the insurance company says “No, you need physical therapy first.” So in order to have the MRI plus surgery covered, you now need to go through months of physical therapy…

— Ashley (@Infosec_Taylor) April 10, 2022

She went on to highlight what she viewed as the stark reality of the U.S. health insurance system in its current form. “So basically, you can have medical insurance, get into a major accident, and still go bankrupt because I don’t know many people with $40k just lying around,” she said.

“But politicians and insurance lobbyists keep telling us we should be GRATEFUL to only have to pay that $40k instead of hundreds of thousands of dollars! And remember, even if you are perfectly healthy and need just a checkup, you are paying $10,400 every year anyway.”

Hitting out at medical insurance as a “billion dollar profit industry” that is “complete and utter garbage” to those who need it, the painful reality was that many on social media were inclined to agree with that assessment.

One user, posting as pfftmaybe, shared what they claimed was their own negative experience of trying to access health insurance.

“I had to switch insurance this year because the insurance I carried last year didn’t think I needed to walk or hold a pencil without pain,” they wrote. “Now last year’s insurance is retroactively denying all my claims and demanding providers repay them and bill me 100 percent.”

AlbySelkie also detailed the difficulties they faced, writing: “I can not and will not be able to walk until I have surgery which IS covered by my insurance. The deductible is $7k+, so I guess I just am screwed until I can magic that amount somehow.”

Saman Barghi, who moved over from Canada, said he was “shocked by how confusing and stressful U.S. health insurance is and the time and productivity it wastes for a simple doctor’s visit,” adding “I thought capitalism benefits when workers are more productive.”

Punksnotdad_ put the situation for many in the U.S. in an alarming perspective, writing: “Most people I know are one broken bone away from financial ruin.”

Dr. Theo J. Herlinghetti claimed medical debt was the “number one cause of personal bankruptcy” in the U.S., noting that “if you get sick you could easily end up impoverished, lose your house, even end up homeless, especially if you have a major chronic illness.”

Those claims appear to be backed up by a 2007 study from the The American Journal of Medicine which found 62.1 percent of bankruptcies were as a result of medical issues.

Some Twitter users did question Infosec_Taylor’s claim that employees pay on average “about $400 per pay cycle,” noting that the figure was steep compared to what they paid.

According to figures from the Bureau of Labor Statistics, 72 percent of workers participating in single coverage medical plans with a contribution requirement had a flat-dollar premium and the median amount was $120.06.

Returning to the thread after it went viral, Infosec_Taylor reflected on the fact that few people were “arguing” in the comments but rather just “coming together with angry and sad resignations that the US health insurance system is a giant trash fire.”

Newsweek has contacted Infosec_Taylor for comment.

The U.S. health insurance system has regularly come under scrutiny in the news and on social media in recent months. In February, a Nevada man made headlines after revealing he was hit with a $13,000 bill after donating a kidney to his cousin.

Earlier that same month, a woman took to TikTok to reveal the medication she needs for her chronic illness will set her back $18,000 a month out-of-pocket.

tyalexanderphotography/Getty

[ad_2]

Source link