Spending Habits: A Glimpse Into Real Life

[ad_1]

Curious what other people’s spending habits are like? Me too! I surveyed my audience and asked you guys to share. Here are the findings!

I have always loved numbers

Math was my favorite subject growing up. I’ve always loved crunching numbers. This started young and I think is a large part of why I was always a good student. Learning new things and getting quizzed on them was a game I was always up for the challenge of going for a 100 on the test. (And the reason why I liked math’s one right answer more than English’s subjective responses.)

I love spreadsheets, trackers, and goal setting.

This propensity toward numbers is why when I set out to lose weight years ago counting calories was fun for me. It’s also why I love creating spreadsheets and projections for my business. When I started a spending budget after getting my first job, keeping track of my money was something I naturally loved. You can actually see how I structured my very first spending budget in this video. (LOL at only spending $200 on groceries!!)

Budgeting helps me feel organized.

I used spreadsheets for years until I was turned on to YNAB (You Need A Budget), the absolute best budgeting software there is!! You can read my review here. And check out this post for tips on how to set up a budget. I am always trying to be as efficient as possible in all areas of my life, so money is no different. How can I squeeze out some money here so I can put that money towards this goal there?

I also love the psychology of how people make decisions.

It’s why I was attracted to nutrition and why budgeting is fascinating to me. I don’t care as much about the granular of investing, but I am most interested in the choices people make when spending their money. I’m interested in your grocery budget and savings rate and how your spending reflects your personal values.

But unlike food, not everyone shares their spending habits!

I have found a few podcasts that use real numbers as case studies. I’ve loved the Finance Friday Edition of Bigger Pockets Money. They interview people who would like help making a plan and go through income, expenses, net worth, and saving. I also discovered Ramit Sethi’s podcast through Bigger Pockets: I Will Teach You To Be Rich. He interviews couples as well to talk real numbers. It’s part therapy session, part financial advice! Ramit has a book too.

“Many people teach us how to save but nobody teaches us how to spend” -Ramit Sethi

So that’s all why I wanted to do this anonymous survey about money! To get a little glimpse into people’s lives and the decisions they make about money.

Spending Habits Survey Results

Limitations

More than 100 people took the budget survey! This was obviously not a scientific study. The sample size is narrow – KERF readers with internet access – and those who opted to fill this out might have a tendency to know more about money than someone who chose not to. I also did not distinguish between currencies, adults vs. children as members of the household, or create a way to filter cohabitating adults vs. single people vs. married combined households. So take all this data with a grain of salt!

The Responses

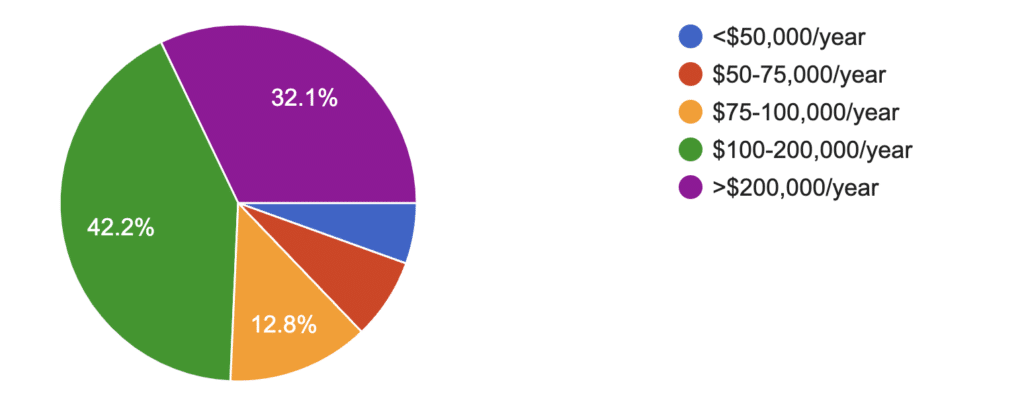

What is your annual combined household income?

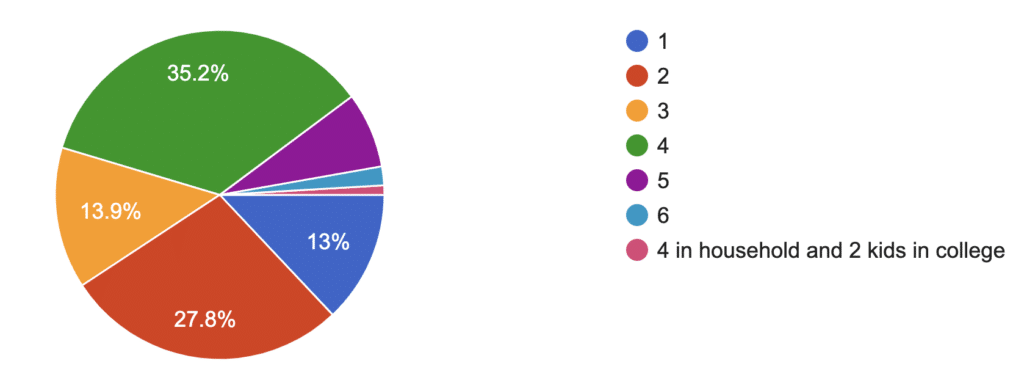

How many people are in your household, including you?

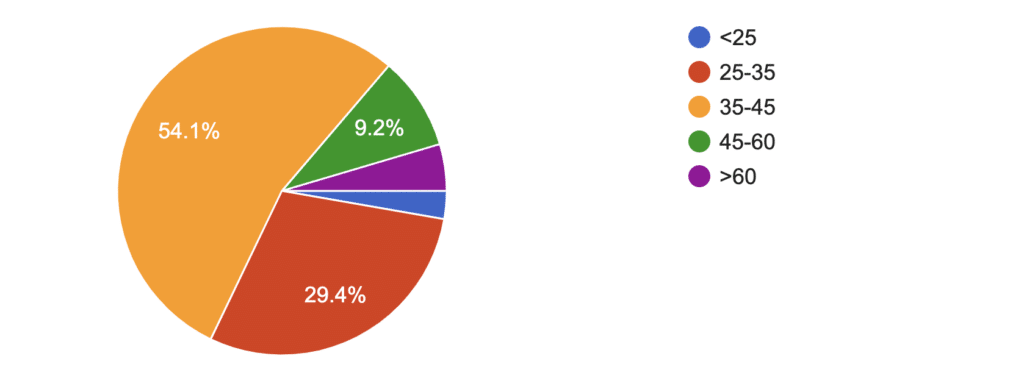

How old are you?

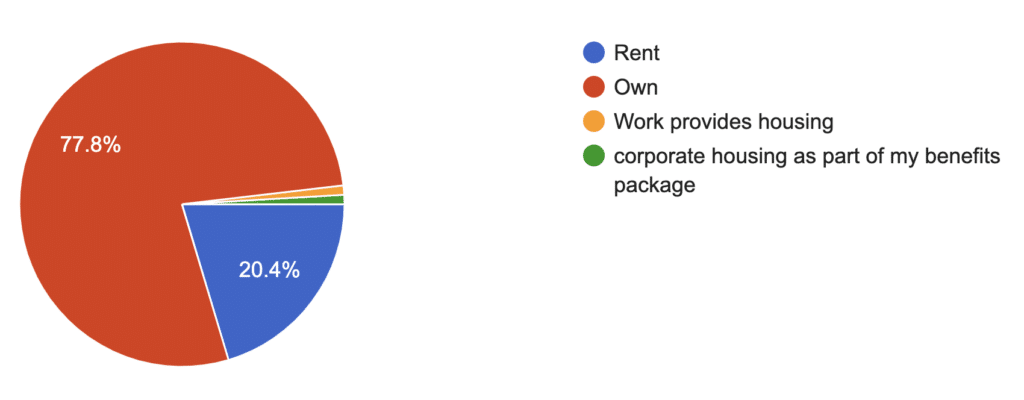

Do you rent or own your home?

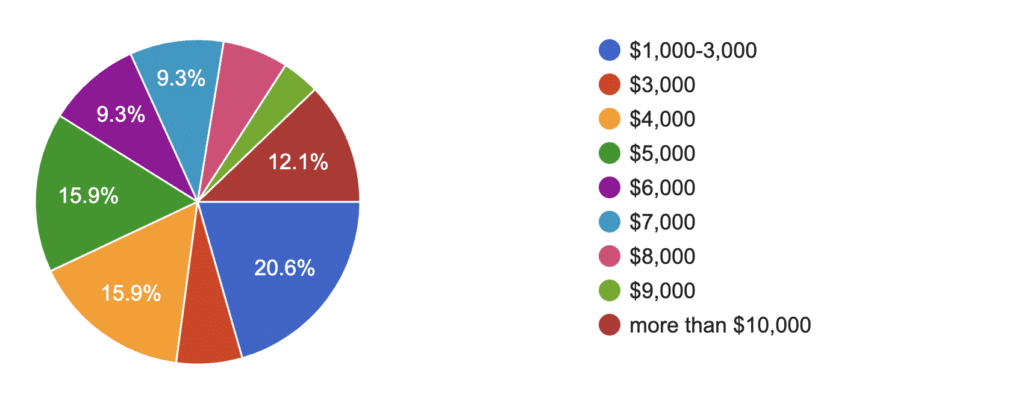

How much do you spend each month? This includes everything (housing, food, childcare, medical, insurance, clothing, spending money, etc.), but not savings.

I would love to dig deeper into this question!!

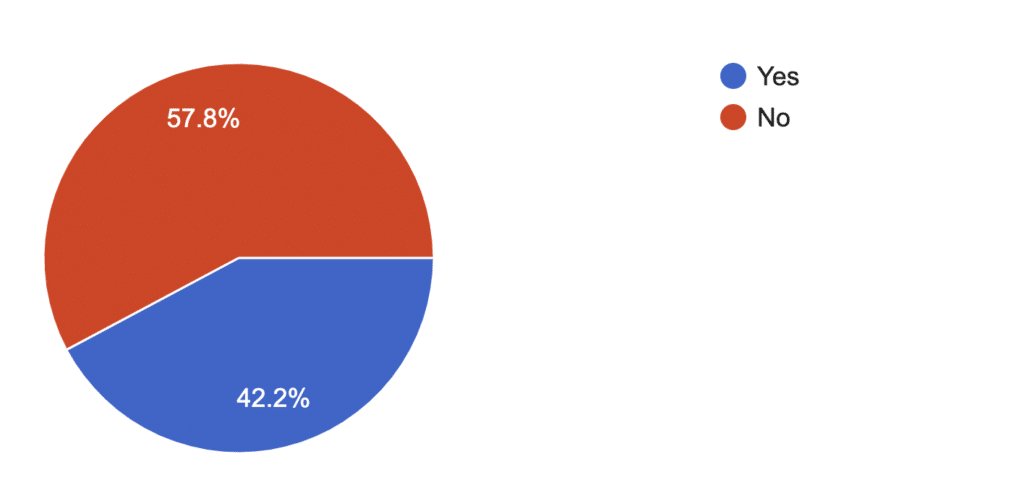

Do you have a monthly budget?

I’m curious how those of you without a budget manage or track your money : )

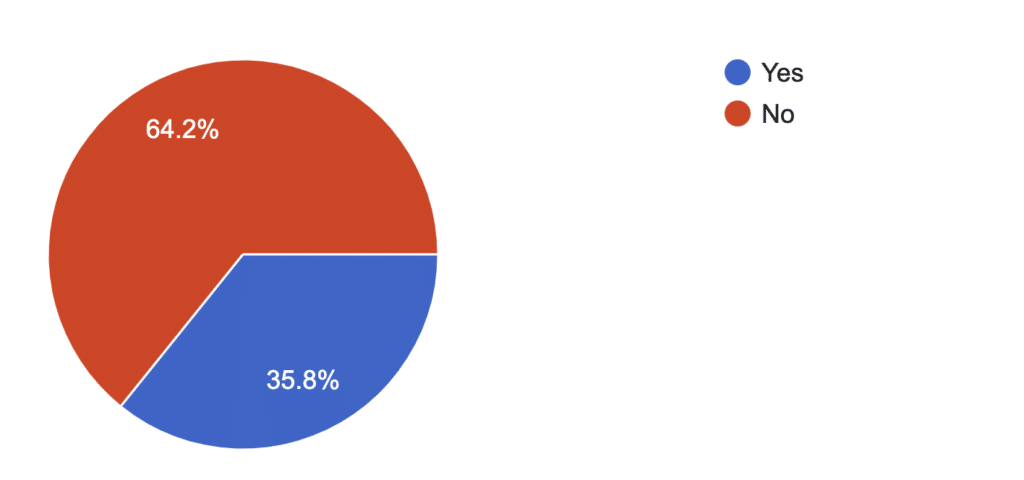

Do you have debt aside from a mortgage?

The types of debt were:

- 24% student loan

- 16% credit card

- 8.5% personal loan

- 17% other

- 57% I do not have debt

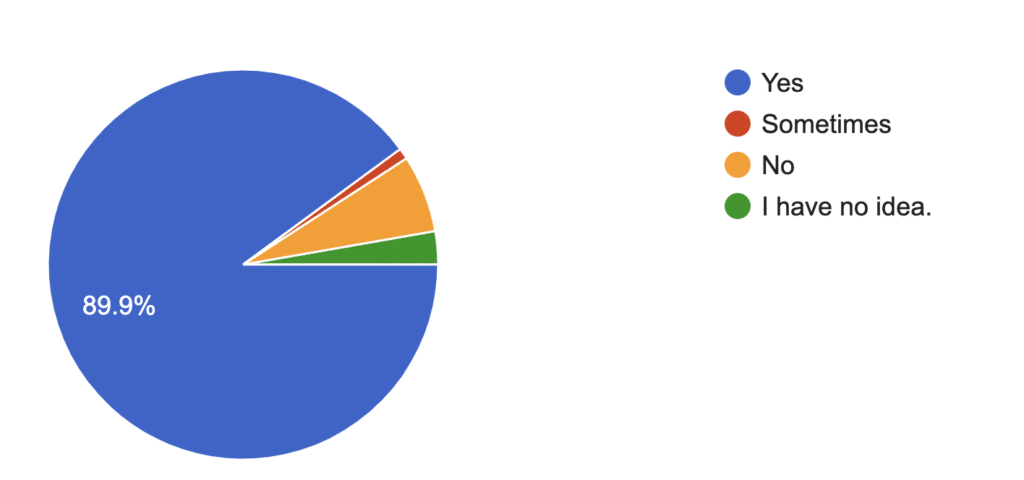

Do you or your partner contribute to retirement accounts?

Impressive!

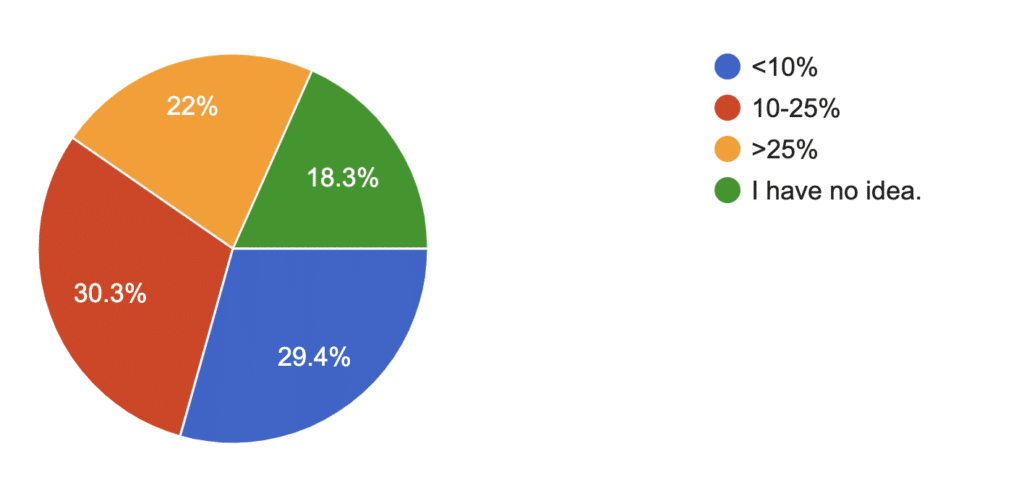

What is your savings rate?

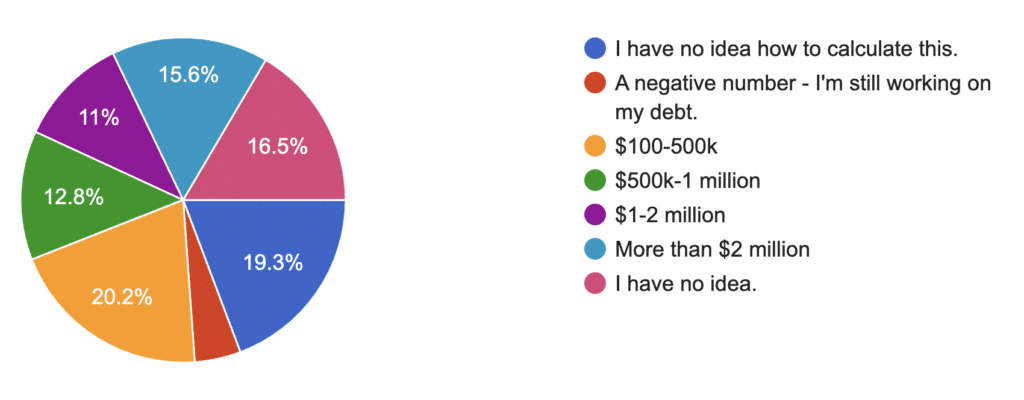

What is your net worth?

Is there an area of your finances/budget that you struggle with the most?

The top responses were:

- Saving/investing

- How to budget

- Planning for the unexpected

- Food/dining out

- Impulse spending

I identify with these common struggles!

Share anything you want about your money journey!

Reading these were my favorite part. Some great wins like paying off debt and great savings. I didn’t include them all, but got a good mix.

- Just climbed out of major debt after a change in employment/ unemployment.

- Student loans are the worst!

- Expenses like IVF have thrown all budgeting attempts out the window! And we’re trying to buy a house but the market here is insane. We just lost a house (listed at $1.4M) to an all-cash buyer at $2.215M. HELP!!

- Student loans have been a huge barrier to saving money. I think we are pretty conservative on money spending and do not have debt outside of student loans and home mortgage.

- How do I get a mortgage in NYC lol?

- I am someone with quite a modest trust fund (I have to work, but really only enough to satisfy the rules of the trust) and I want to buy an apartment that is a co-op or condo. But there are extremely strict rules! If you could walk people through that, it would be a super-interesting post!

- Having a budget helps me feel calm, I don’t see it as restrictive but more as a tool to reach our long term goals. We don’t follow it perfectly each month but retirement savings and extra to the mortgage each month are musts.

- My partner and I took advantage of the zero percent interest on a student loan (interest stopped accruing due to the pandemic – best thing to happen!) and kept making regular payments and now it is paid off!

- We have invested in real estate in the Miami area – buying homes (and now buildings) and renting them, mostly residential but dabbling in some commercial as well.

- Don’t have a set budget but we are both quite frugal so it works itself out. When we really want/need something we get it but otherwise we get by with what we have. We each have splurges but don’t need to keep track because it’s never out of control.

- Automating everything and having any money attached to my debit card be spending money has been a game changer! If I can “see” it I can spend it. All bills, savings, goals savings come out before we each get our “allowance”.

- Many years of grad school and doing everything 100% on my own left me with no savings or retirement! Now that I have a good job (using my degrees!?), I am 100% focused on saving so I can travel one day. It’s been a decade since I’ve had a vacation.

- We have a nice amount in savings. Baby due 4/2 so looking into investing for baby’s future as well. Hubby dabbles in crypto and some stocks. No real debt besides mortgage, car loans. Hubby owns his own businesses (5 of them) so our income can fluctuate dramatically month to month (I have a stable 9-5 job).

- Becoming debt free has been a blessing in being able to start saving money in general as well as being able to begin collecting towards a down payment on a home in the future.

- We’re DINKS and really spend a lot of time thinking about FIRE. We max out all possible retirement accounts (401ks, Roth/Traditional IRAs, HSAs). We don’t actively budget (because we’re lucky enough to not really have to), but I keep a very close eye on our accounts and we use Mint daily to keep track of everything.

-

Roughly 1/3 of our savings is from inherited wealth, so I don’t like counting it.

- We save a lot here in Alaska because it’s harder to casually shop or travel locally, but that means we spend more on shipping luxury goods and traveling farther!

- One thing I am very proud of, that I wish others took more seriously, is the idea of living not just within your means, but WELL BENEATH your means. My husband and I always did this as singles, so it’s easy to continue as a couple. Our incomes have increased over the years, but our expenses haven’t (now that we have no more daycare costs, they’ve actually decreased!). It’s so easy to save and invest money when you have this mindset. It sets us up for early retirement and a lot of freedom & flexibility should one of us want to pursue a different passion or not work altogether.

- I always find your money posts interesting! Our combined income is nearly 200k – which I know is significantly higher than many many people. But we’ve handled our finances in a similar way when we were making less than half that. We have our accounts set to up automatically transfer a certain amount to our saving account, retirement accounts, and kid college funds (we have two kids). We both contribute to our work retirement accounts – my husbands company matches 10% – mine far less but we meet or exceed the match. The only debt we have is on the house (but may be adding a car payment this year – one is about to die…). Our attitude is that we if we are able to meeting our savings goals, we don’t have to micromanage the rest of it by having a budget. It works – a couple times a year we transfer extra money out of checking to savings. We also don’t really have expensive tastes so that helps.

- I did not have a monthly budget until the pandemic hit and I was worried about losing my job. I have no idea if I am doing it well or the best way I could be.

- When we married, and I still worked full time, we lived only on my husband’s income (saving mine) which gave us the flexibility for me to return to work part-time when our first of two children was born. He now earns a larger salary and we moved states and I am still working only part-time and saving my income.

- We got really lucky with some early employee stock options that allowed us to leave our jobs. It is not normal, but it is nice not to work for someone!

-

YNAB is the best thing that ever happened to my money.

AMEN on that last one! Haha.

More Thoughts On Spending

How to calculate net worth

Almost 20% of people checked the “I don’t know how to calc this” box so I thought I would clarify! Your net worth is all of your assets (cash, investments, home equity, retirement accounts, etc.) minus any debts you owe (mortgage, student loans, credit cards). It’s not uncommon to graduate from college with a negative number and then as student loans are paid off move into the positives and keep climbing. Net worth is a net number, so you could have $1 million in net worth if you have $10 million in real estate and $9 million in mortgages or if you had $1 million in investments and cash and zero debt. Obviously those two situations are very different!

What is a savings rate?

Your savings rate is the gap between the money you earn (after tax) and the money you spend AKA how much are you saving? If you bring home $100k and spend $80k that means you’re saving $20k, or 20%.

This is one of the most popular articles on savings rate from Mr. Money Mustache. Note the cool chart he included with savings rate percentage and years to being financially independent. This savings rate calculator can help too! You will need to know how much you spend and how much you save to be able to calculate this, and if you don’t know those numbers you should do a little tracking! It’s good to track at least once a year and see where your spending habits fall.

Fixed vs. Flexible Expenses

I hear a lot on the podcasts I listen to that your big fixed lifestyle expenses are the most important: housing, food, transportation. If you can find a way to keep those to a smaller percentage of your spending then you will be able to have a much larger savings rate.

An example of this might be renting out the basement of your home to offset the mortgage, choosing to live in a lower cost of living area, or becoming a one car household if you live somewhere that biking and walking are feasible. Obviously not everyone can do everything, but there are many creative ways to house hack or reduce these fixed expenses.

When fixed expenses are low, then you can bump the spending on your flexible expenses up when you can and if times get tough, like a job loss or pandemic crisis, you can easily cut out the extra and still be OK.

Please share something about your money journey to keep the conversation going!

More posts from Kath:

[ad_2]

Source link